Stay ignorant and hope you accidentally become profitable (hint: it doesn’t work this way!).This isn’t always easy, especially if you’re working on tight profit margins, but you really have two options: Can you offer something else, or can you increase your prices? This isn’t just a semantic change of variables, it also affects how you look at your. The Profit First formula gives the profit portion the highest priority: Sales Profit Expenses.

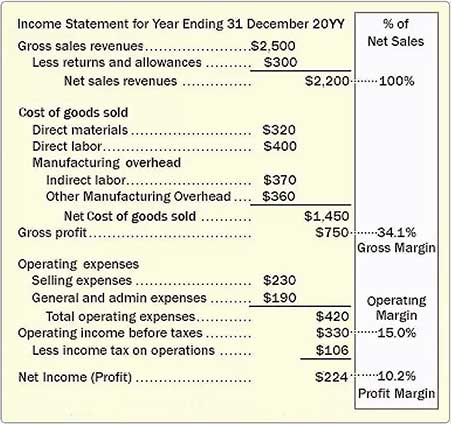

If you need more money coming in, think about ways to raise that money from your clients. While it makes sense to set aside money for expenses first, it doesn’t guarantee that there will always be profit, only that the expenses will be paid. You need to be disciplined and work with what you have available. You have too many expenses, or your allocation percentages are off. It would apply a fixed percentage mark-up to determine its routine profit. If you need to, it’s a sign that something is off. first detailed reform proposal: the Residual Profit Allocation by Income. You can’t cheat and keep moving money around. There’s a great cheat sheet here (page 2 + 3) which you can use to see the timing Mike recommends for managing your money. Mike recommends dealing with your money around twice a month, but you may need to do so more often in the beginning. OPERATING EXPENSES: the account all your expenses are paid fromįinally, you actually have to implement the system, and this requires a little bit of discipline.OWNER’S COMPENSATION: The money you get for your salary.INCOME: A main account, in which all incoming money is fed into.Mike recommends using the following different bank accounts to do this: Mike recommends that you not only take your profit first but use an envelope system for budgeting for your business so the profit you take is never eaten by the business. It stops you from calculating profit later and puts it as a priority. In other words, you don’t spend more than you can afford to without eating into your desired profit. Profit First challenges you to look at it like this: This represents how your revenue is currently spent and serves as a benchmark against TAPS. Infographic Profit First helps you establish target allocation percentages for your revenue. Start out with your Current Allocation Percentages (CAPS). Profit First turns the traditional accounting model on its head. Profit First encourages business owners to think in terms of different percentages. Of course, it is both this simple and not this simple in practice. Profit First is based on a waterfall system where all income flows into your top income account, and then on the 10th and 25th of every month, this cash is. Audio Book Readers: The Graphics & Charts from Profit First. Logically the math is the same, but from the standpoint of the entrepreneurs behavior it is radically different. Profit First is a book and method by Mike Michalowicz, Profit First is about taking your profit first (like the pay-yourself-first method of personal budgeting) so you will always turn a profit. Profit First Overview & Profit First One-Sheet. With Profit First you to flip the formula to Sales Profit Expenses.

0 kommentar(er)

0 kommentar(er)